Introduction

Warren Buffett has achieved an astounding return on capital through a value investing philosophy premised on unbridled optimism in America. To this point, Mr. Buffett concluded the virtual 2020 Berkshire Hathaway annual meeting – famously called “Woodstock for Capitalists” – with the command, “Never bet against America.”1 His unshakable confidence in the nation’s continued progress does not appear to account, however, for dramatic changes since the “Oracle of Omaha” made his first investment in 1942 at age 11.2 Does Mr. Buffett’s belief in perpetual American prosperity ignore troubling trends that argue for a more measured assessment of the country’s economic future?

Warren Buffett’s Bet on American “Magic”

For more than two decades, Mr. Buffett has offered sociological commentary on why “Berkshire prospers in America as it would nowhere else.”3 Mr. Buffett contended during the recent shareholder meeting: “What we have accomplished is miraculous. … The American Dream is the wonder of the world.”4 Mr. Buffett spent an hour and a half during the meeting to “convince [shareholders] to never bet against America.”5

Mr. Buffett believes, perhaps more than anything else, that the American “system” will inevitably “unleash human potential.”6 This “American tailwind” – a term coined by Mr. Buffett – is nothing less than “marvelous,” whatever the uncertainties of the moment.7 Mr. Buffett does not attribute the success of America primarily to the character of her people. In 2016, he theorized, “Early Americans, we should emphasize, were neither smarter nor more hardworking than those people who toiled century after century before them. But those venturesome pioneers crafted a system that unleashed human potential, and their successors built upon it. This economic creation will deliver increasing wealth to our progeny far into the future.”8

Expanding on his view, Mr. Buffett identified four inputs that help “deliver abundance beyond any dreams of our forefathers”: human ingenuity, talented and ambitious immigrants, the rule of law, and – most crucially – the nation’s market system.9 Regarding this last factor, Mr. Buffett wrote: “Above all, it’s our market system – an economic traffic cop ably directing capital, brains, and labor – that has created America’s abundance.”10 Mr. Buffett has credited this economic system, not the citizenry, for America’s resilience: “Human potential is far from exhausted, and the American system for unleashing that potential – a system that has worked wonders for over two centuries despite frequent interruptions for recessions and even a Civil War – remains alive and effective.”11

Social Capital Decline: 1942 to 2018

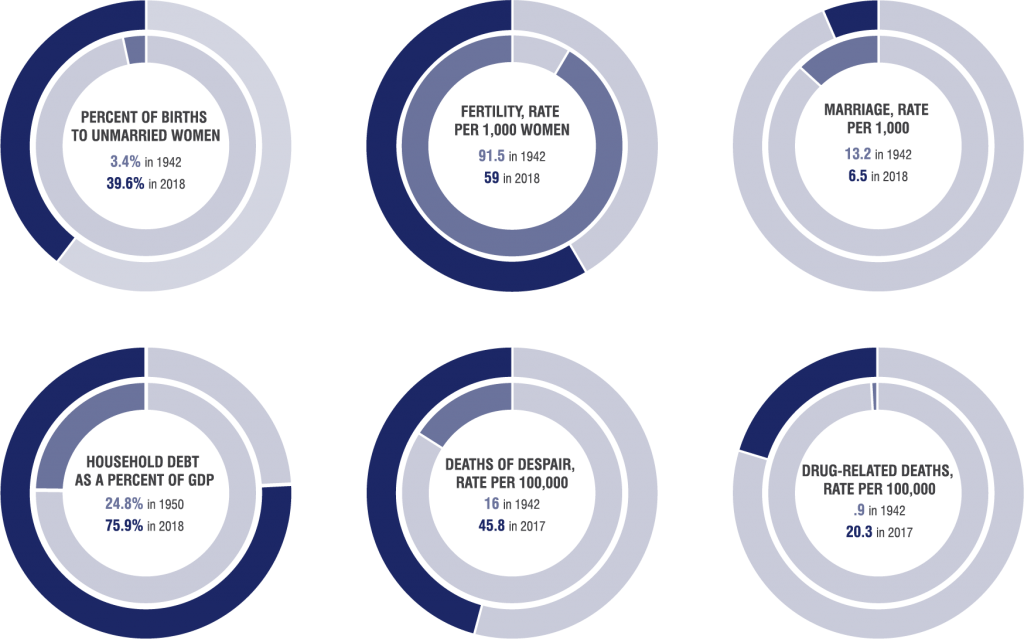

Mr. Buffett rarely has addressed the broader relationship between the nation’s social fabric and a robust economy. More personally, Mr. Buffett recently recalled that his father and mother “got along very well.”12 Regrettably, a declining proportion of Americans have benefited from such a nurturing background in the decades following Warren Buffett’s first investment on March 11, 1942.13

Impact on Economic Growth

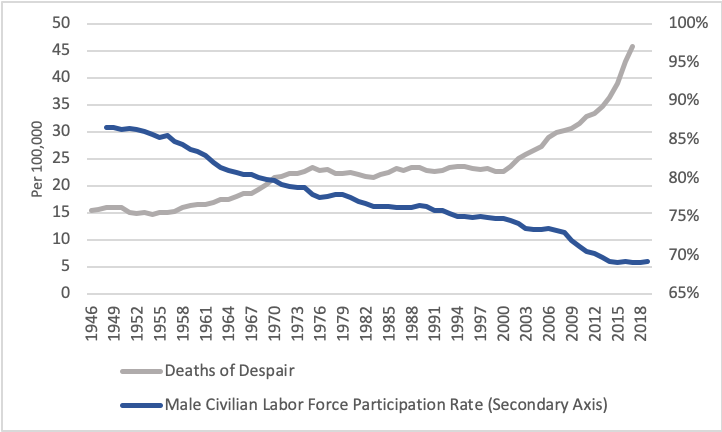

Although correlation does not equal causation, the male labor force participation rate has decreased nearly 20 percentage points and deaths of despair have increased more than 180 percent in the past 70 years.14 As embodied by these statistics, a broad, ongoing collapse in social capital increasingly constrains the nation’s labor force, notwithstanding a plethora of dynamic opportunities.15 Despite aggressive pro-growth measures enacted by the current Administration even before the pandemic, annual GDP increases struggled to reach 4 percent. The Federal Reserve Bank of San Francisco concluded in 2019, “Achieving GDP growth consistently above 1¾ percent will require much faster productivity growth than the United States has typically experienced since the 1970s.”16

Slower growth rates could reflect the reduced capacity of individuals to take advantage of economic opportunity. If so, COVID-19 likely will reinforce and accelerate this trend: opioid relapses have risen, while mental health and general happiness have fallen.17 The contemporaneous decline in social capital and growth rates remains an underappreciated factor by economists and policy makers. Both political parties focus instead on allocating resources and benefits: the Left through spending on social programs and the Right through marginally lower tax rates. These approaches neglect, however, the deteriorating condition of the “intermediating institutions” – most of all the family – central to individual, and ultimately national, wellbeing.

Outlook

In February 2020, policy expert Oren Cass observed, “Recent decades of economic growth have eroded, rather than reinforced, the American model of thriving, self-sufficient families,” citing the increasing difficulty American households face in purchasing “major items that a family of four would likely seek to buy” with median weekly wages.18 He concluded: “The decades to come will need to do better.”19

Alexis de Tocqueville identified the American character as the source of the nation’s economic success: “All those quiet virtues which tend to give a regular movement to the community, and to encourage business, will therefore be held in peculiar honor by that people, and to neglect those virtues will be to incur public contempt.”20 The “quiet virtues” that serve as the foundation of strong social capital have persistently declined in recent decades with profound consequences for the American system.

Mr. Buffett has built a legendary fortune by betting on America, dismissing the doubters as “prophets of doom.”21 But 2020 America should not be mistaken for 1942 Omaha. The American system cannot continue to unleash potential, and support an economy highly dependent upon the purchase of durable goods for housing and transportation, if the foundation of community, family, and meaning that supports individuals collapses.

© 2020 Baron Public Affairs, LLC. All Rights Reserved. No part of these materials may be reproduced or transmitted in any form or by any means, electronic or mechanical, including but not limited to photocopy, recording or any other information storage or retrieval system known now or in the future, without the express written permission of Baron Public Affairs, LLC. The brief does not constitute advice on any particular investment or commercial issue or matter. No part of this brief constitutes investment or legal advice and is not to be relied upon as such. The unauthorized reproduction or distribution of this copyrighted work is illegal and may result in civil or criminal penalties under the U.S. Copyright Act and applicable copyright law.

Endnotes

1 Warren Buffett, “2020 Berkshire Hathaway Annual Meeting,” CNBC, May 2, 2020, https://buffett.cnbc.com/2020-berkshire-hathaway-annual-meeting.

2 Warren Buffett, “Warren Buffett’s 2018 Letter to Shareholders,” Berkshire Hathaway, https://www.berkshirehathaway.com/letters/2018ltr.pdf.

3 Warren Buffett, “Warren Buffett’s 1996 Letter to Shareholders,” Berkshire Hathaway, https://www.berkshirehathaway.com/letters/1996.html.

4 Warren Buffett, “2020 Berkshire Hathaway Annual Meeting,” ibid.

5 Ibid.

6 Warren Buffett, “Warren Buffett’s 2016 Letter to Shareholders,” Berkshire Hathaway, https://www.berkshirehathaway.com/letters/2016ltr.pdf.

7 Mr. Buffett referenced American “magic” (see section title) at the 2020 annual meeting. Warren Buffett, “2020 Berkshire Hathaway Annual Meeting,” ibid.

8 Warren Buffett, “Warren Buffett’s 2016 Letter to Shareholders,” ibid.

9 Ibid.

10 Ibid.

11 Warren Buffett, “Warren Buffett’s 2010 Letter to Shareholders,” Berkshire Hathaway, https://www.berkshirehathaway.com/letters/2010ltr.pdf.

12 Warren Buffett, “2020 Berkshire Hathaway Annual Meeting,” ibid.

13 “Nonmarital Childbearing in the United States, 1940-1999, ”Centers for Disease Control and Prevention, October 18, 2000, https://www.cdc.gov/nchs/data/nvsr/nvsr48/nvs48_16.pdf; “Births: Final Data for 2018,” Centers for Disease Control and Prevention, November 27, 2019, https://www.cdc.gov/nchs/fastats/unmarried-childbearing.htm; “Live Births, Birth Rates, and Fertility Rates, by Race: United States, 1909-2000,” Centers for Disease Control and Prevention, https://www.cdc.gov/nchs/data/statab/t001x01.pdf; “U.S. Fertility Rate Explained,” Pew Research Center, May 22, 2019, https://www.pewresearch.org/fact-tank/2019/05/22/u-s-fertility-rate-explained; Sally C. Curtin and Paul D. Sutton, “Marriage Rates in the United States, 1900-2018,” Centers for Disease Control and Prevention, April 2020, https://www.cdc.gov/nchs/data/hestat/marriage_rate_2018/marriage_rate_2018.pdf; “Household debt, loans and debt securities,” International Monetary Fund, 2018, https://www.imf.org/external/datamapper/HH_LS@GDD/USA; and “Long-Term Trends in Deaths of Despair,” United States Congress Joint Economic Committee, September 5, 2019, https://www.jec.senate.gov/public/index.cfm/republicans/2019/9/long-term-trends-in-deaths-of-despair.

14 “Current Employment Statistics,” U.S. Bureau of Labor Statistics, retrieved from the Federal Reserve Bank of St. Louis, https://www.bls.gov/ces; and “Long- Term Trends in Deaths of Despair,” ibid.

15 Social capital is defined as “the non-financial, often intangible assets that one gains from interactions with one’s community.” Mary Clare Amselem, “Rebuilding Social Capital Through Community Institutions,” The Heritage Foundation, December 6, 2013, https://www.heritage.org/poverty-and-inequality/report/rebuilding-social-capital-through-community-institutions.

16 John Fernald and Huiyu Li, “Is Slow Still the New Normal for GDP Growth?” Federal Reserve Bank of San Francisco, June 24, 2019, https://www.frbsf.org/economic-research/publications/economic-letter/2019/june/is-slow-still-new-normal-for-gdp-growth.

17 Marcelina Jasmine Silva and Zakary Kelly, “The Escalation of the Opioid Epidemic Due to COVID-19 and Resulting Lessons About Treatment Alternatives,” The American Journal of Managed Care, Vol. 26, No. 7 (June 1, 2020), https://www.ajmc.com/journals/issue/2020/2020-vol26-n7/the-escalation-of-the-opioid-epidemic-due-to-covid19-and-resulting-lessons-about-treatment-alternatives; Fernando Alfonso III, “The pandemic is triggering opioid relapses across Appalachia,” CNN, May 14, 2020, https://www.cnn.com/2020/05/14/health/opioids-addiction-appalachia-coronavirus-trnd/index.html; Ashley Kirzinger, Audrey Kearney, Liz Hamel Follow, and Mollyann Brodie, “KFF Health Tracking Poll – Early April 2020: The Impact Of Coronavirus On Life In America,” Kaiser Family Foundation, April 2, 2020, https://www.kff.org/coronavirus-covid-19/report/kff-health-tracking-poll-early-april-2020; and Tamara Lush, “Poll: Americans are the unhappiest they’ve been in 50 years,” Associated Press, June 16, 2020, https://apnews.com/0f6b9be04fa0d3194401821a72665a50.

18 Oren Cass, “The Cost-of-Thriving Index: Reevaluating the Prosperity of the American Family,” Manhattan Institute for Policy Research, February 2020, https://media4.manhattan-institute.org/sites/default/files/the-cost-of-thriving-index-OC.pdf.

19 Ibid.

20 Alexis de Tocqueville, Democracy in America, Volume II, Frankfurt, Germany, 2018, page 272.

21 Warren Buffett, “Warren Buffett’s 2010 Letter to Shareholders,” ibid.